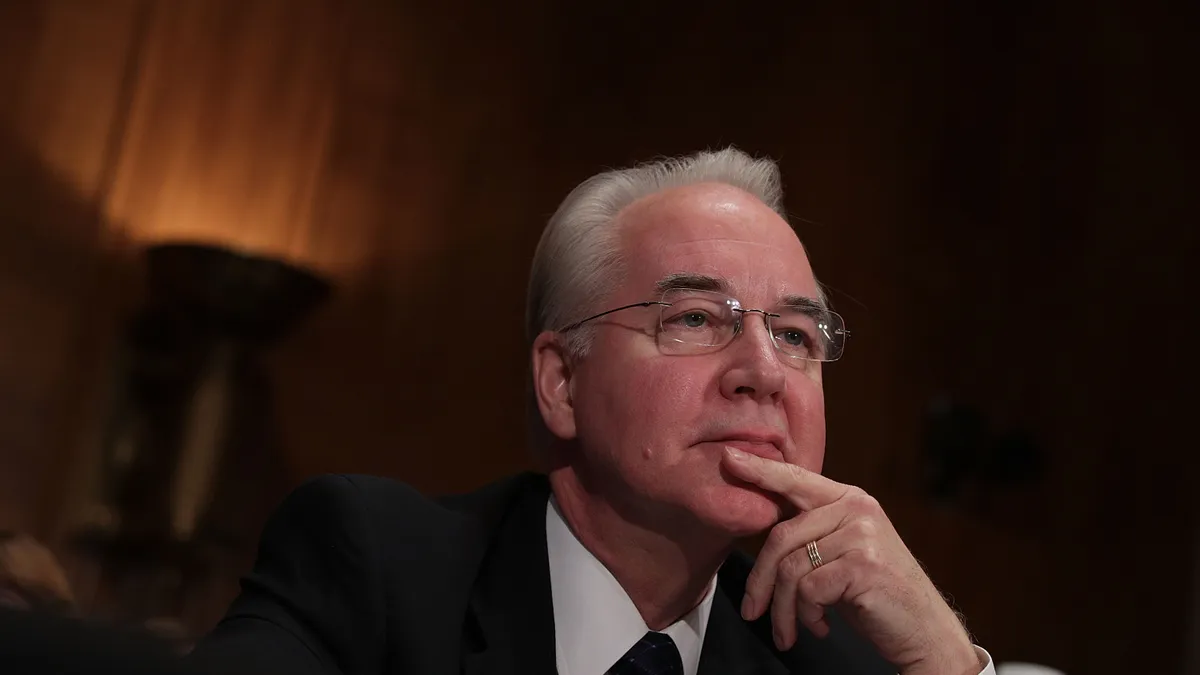

Editor’s note: Tom Price served as HHS secretary in 2017, and is also a former U.S. congressman from Georgia. Price is currently a board member and advisor for a number of public and private companies.

The healthcare and medical industries have always involved lawsuits. We are all familiar with TV commercials and radio ads asking if “you or a loved one” has had a certain condition or procedure, and promising big payouts.

But now, a new and surprising source of litigation is jeopardizing medical progress. Litigation investment entities, groups that invest in lawsuits to enrich themselves, have homed in on intellectual property, making deceptive patent infringement claims to line their pockets at the expense of innovation and technological progress.

When serving in Congress, and later as secretary of the HHS, I pushed to modernize the way we serve patients, both within the department and out in the real world. It’s critical that we remain vigilant against bad actors who manipulate the legal system to target companies that are making new technological advances that will bring the next generation of breakthroughs in the field of healthcare.

Litigation investment entities and third-party litigation funders place bets on lawsuits. They provide funding for the upfront costs of legal action. As an alternative, they own shell companies that file lawsuits and then profit if they get a favorable award or settlement. The possibility of large verdicts in patent infringement cases has motivated investment entities to place a particular focus on intellectual property.

The lawsuits have serious consequences. The investment entities and companies they own don’t make anything productive themselves, but their most promising targets are often the most cutting-edge companies or up-and-coming new technologies.

When litigation funders acquire patents and file lawsuits, they impose huge costs on the innovators who are actually driving progress. Cases involving Fortress Investment Group, a private equity firm owned by a multinational conglomerate, show the different ways litigation funding entities can burden innovators and slow new developments in the medical space.

The damage to medical innovation is sometimes obvious, with lawsuits against medtech companies. In one case, Fortress acquired patents from the now infamous, fraudulent medical technology company Theranos. A shell company owned by Fortress, Labrador Diagnostics, then used a pair of those patents to sue a company making COVID-19 tests in March 2020, when tests were in high demand.

The damage can also be indirect, with lawsuits targeting keystone technologies that support advancements across sectors, including healthcare.

Another Fortress-backed shell company, VLSI Technologies, has brought a series of patent infringement lawsuits against Intel, the largest American semiconductor manufacturer. Intel has been ordered to pay VLSI, a company that makes no products of its own, billions of dollars as a result of patent infringement lawsuits.

Estimates show that half of all medical devices include a semiconductor, and VLSI’s lawsuits came as semiconductor shortages were contributing to rising prices and supply chain delays.

Although both patents owned by Fortress were finally declared invalid this year, Intel was still forced to waste time and money defending itself against abusive litigation that never should have been brought in the first place.

The Fortress, Labrador and VLSI relationships are public, but that isn’t standard. In many lawsuits supported by litigation funding entities, funders are able to remain anonymous.

For shell-company plaintiffs, this is a huge advantage, allowing them to spin misleading narratives for judges and juries, while accessing vast resources behind the scenes.

As some have correctly warned, this arrangement also exposes strategically important U.S. industries like healthcare to the risk of foreign interference.

U.S. courts must level the playing field between litigation investment entities and the innovators they attack. A first step is making funders step out of the shadows.

A few courts have begun enforcing funding and ownership transparency from all parties. This must be applied across the board to begin cracking down on exploitative lawsuits. The healthcare industry needs as many advancements as possible as quickly as possible.

We cannot afford to have breakthroughs slowed by opportunistic litigators, who only want to enrich themselves. It’s past time for greater transparency.