Steward Health Care is on the clock.

The Dallas-based healthcare network has until the end of the month to prove to lenders it has the cash on hand to begin repaying its significant debts — or it could face bankruptcy proceedings.

Demonstrating solvency could be a tall order because the health system owes a lot of parties a significant amount of money, according to analysts familiar with the system.

Should Steward fail, it would be one of the largest provider bankruptcies in decades, said Laura Coordes, professor of law at the Sandra Day O'Connor College of Law at Arizona State University.

Steward operates more than 30 hospitals across eight states and serves mostly public pay patients, according to a company spokesperson. It has already shuttered hospitals in Texas and Massachusetts due to financial difficulties.

Steward said in February it had a plan to address its cash crunch and exit its forbearance period as a sustainable company, which included engaging restructuring advisors, taking out another bridge loan and selling its physician group and other assets.

Analysts question the feasibility of Steward’s recovery plan, noting the scale of its financial trouble, the significant regulatory roadblocks to selling assets and a multitude of challenges to further extending the healthcare network’s credit line.

Some believe a bankruptcy filing is a likely — if not inevitable — conclusion for Steward.

“There’s going to be an endpoint when things completely implode,” said Mary Bugbee, senior coordinator at the Private Equity Stakeholder Project. “I would argue it’s imploding right now. I wouldn’t be surprised if we see a bankruptcy.”

The roots of Steward’s financial troubles

Steward, which formed in 2010 when private equity firm Cerberus Capital Management purchased six struggling Massachusetts-based hospitals, has always carried a high amount of debt.

Just three years after its founding, the health system’s debt had already exceeded its equity by several multiples, according to a 2015 report from the Massachusetts attorney general.

However, Steward’s problems increased dramatically when it partnered with hospital landlord Medical Properties Trust in 2016, said Rosemary Batt, who studies the financialization of healthcare at Cornell University’s Industrial and Labor Relations School.

Steward and MPT engaged in real estate sales and leaseback plays, a “classic” private equity financial strategy that often leaves asset companies saddled with debt, according to research published by Batt. The sales can give private-equity owned companies quick access to capital to expand or pay down debt while benefiting investors, she said. Funders for Cerberus, for example, made $484 million off the first Steward sale-leaseback deal.

But profitable healthcare chains usually don’t conduct leasebacks with real estate investment trusts like MPT because high rents cut deeply into net revenues, said Batt.

REIT rental agreements are long-term and “triple net,” meaning tenants are on the hook for all expenses — including maintenance, repairs, utilities, taxes and insurance — in addition to rent.

To make matters worse, Steward’s rents increase annually, with some hospital rents increasing by 5% each year.

Medicaid and Medicare payments — upon which Steward says it derives most of its patient revenue — can’t keep up with such increases.

REITs have been associated with prominent healthcare bankruptcies, including the 2018 folding of Carlyle Group-backed nursing home chain HCR ManorCare, which owed $446 million in rent at the time of its filing.

“Cerberus had to have known what it was doing” when it saddled Steward with a MPT lease, Batt said, referring to the risk of bankruptcy.

Over the past eight years, Steward has sold hospitals to MPT for at least $4.9 billion and then leased the property back, according to Healthcare Dive review of MPT’s financials. At the height of its relationship with MPT, Steward leased 41 properties from the landlord in 2022, according to a regulatory filing.

According to Steward’s last available audited financial report, the company owed $385.2 million a year in rent to MPT in 2020 for operations at 35 hospitals and was projected to owe $423 million by 2024. Steward has downsized slightly, and analysts estimate it now owes just shy of $400 million in rent annually.

Steward hasn’t kept up on rent payments. MPT alleges Steward owes $50 million in missed rent — on top of an additional $50 million for rent payments that the landlord previously allowed the health system to defer. Steward’s true rent debt is likely higher after accounting for money MPT loaned Steward for capital improvements, according to Rob Simone, sector head of real estate investment trusts at analyst firm Hedgeye.

"No healthy hospital system can survive without its property."

Rosemary Batt

Professor at Cornell University’s Industrial and Labor Relations School

“If I look at the amount of rent that Steward owed MPT over the last two years on a net basis, Stewart has paid about 50%,” he said. “Meaning, MPT gave them a break in various ways and in various places on half their rents that we know of, and they still failed.”

How was Steward able to stay afloat for so long?

Steward likely burned over a billion dollars between 2017 and 2021 attempting to keep up with MPT rents, analysts said.

Meanwhile, MPT was acting as both Steward’s landlord and lifeline, providing the healthcare network with regular cash infusions that were atypical of REIT models, such as a $50 million general capital loan for repairs following flooding at Norwood Hospital in Massachusetts.

In total, MPT gave Steward approximately $1.7 billion in non-real estate funding since 2018, according to Hedgeye’s Simone.

The cash, alongside $400 million in COVID-19 relief funds, likely prevented a Steward bankruptcy in 2020, Simone said.

Keeping Steward solvent was valuable for MPT because it allowed the real estate investment trust to collect rent from its largest asset and, in turn, generate dividends for investors.

“MPT loans money to Steward, and there's never a rent cut… that allowed MPT to continue showing earnings to their investors, [while] on the back end, sending loans to Steward to keep the whole thing afloat,” explained Simone. “It's a Ponzi scheme. It's a total circular reference.”

However, MPT’s ability to prop up Steward was strained when some of its other assets, including Prospect Medical Holdings, began to miss rent payments.

By December 2023, Moody’s Ratings reported that MPT was significantly exposed by tenants’ liquidity problems; MPT’s stock plummeted from trading at $23.25 a share in January 2022 to $3.99 by mid-April.

In January, MPT sought to limit its exposure to Steward, citing concerns about its solvency. It publicly declared Steward was behind on its rent and asked to be repaid, even though the real estate trust had been financially supporting Steward since at least 2018, according to its financial statements.

Steward’s financial position is partially the fault of MPT, according to the ILR School’s Batt.

MPT claims to be the second largest non-government owner of hospitals in the world and boasts on its website that it understands healthcare and knows hospital needs. However, Batt says MPT’s rental agreements lead to worse quality, because tenants rarely have enough funds leftover after rent comes due to invest in advancements that could benefit patient care.

Health systems in MPT’s portfolio routinely sacrifice technology investments, equipment upgrades, staff training and wage increases to make rent payments, she said.

“High debt, low profitability, lower or declining liquidity — all of those factors are outcomes of your financial strategies,” said Batt. “All of that was created… with selling off all the property… No healthy hospital system can survive without its property.”

Will an asset sale prevent a bankruptcy filing?

As Steward seeks to exit its forbearance period, the health system has considered selling assets to pay down its debts.

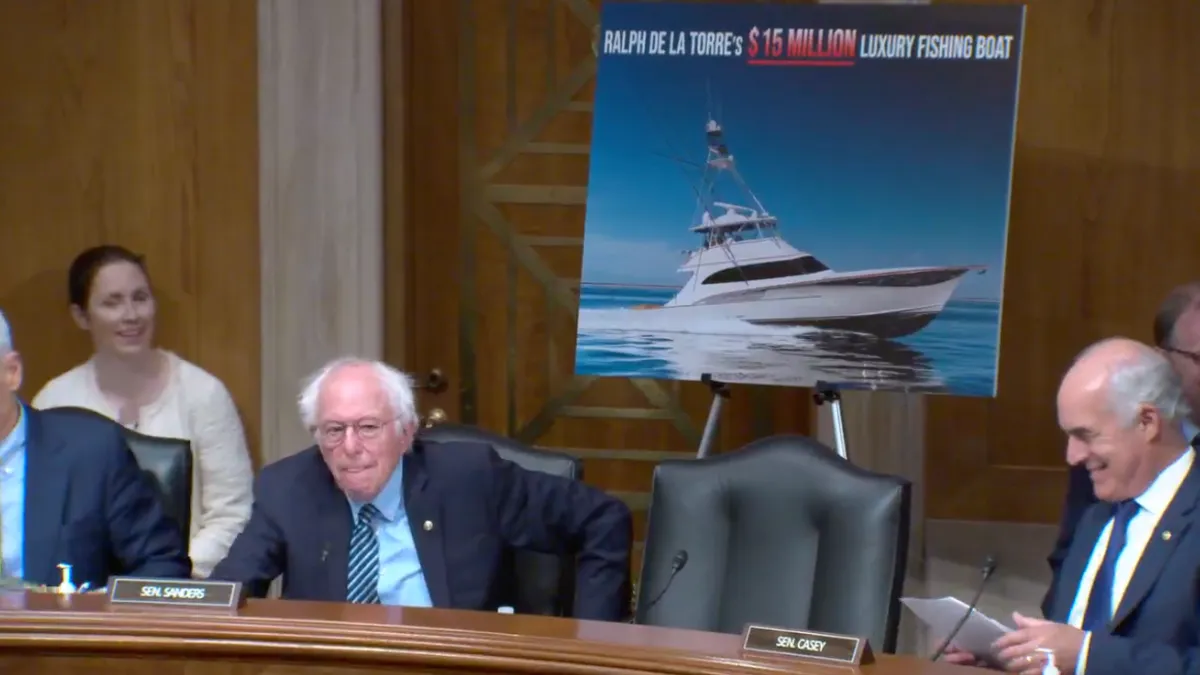

Last month, Steward said it would sell its physician group, Stewardship Health, to UnitedHealth subsidiary Optum Care. But lawmakers have already urged regulators to review the deal, and no details have emerged about a price.

Analysts are skeptical the proposed deal will close. If it does, they doubt it will happen in time to move the needle on Steward’s current financial position — especially because the Massachusetts regulatory board tasked with overseeing the deal hadn’t begun its review as of mid-April.

Healthcare deals have also been taking longer to close on average, sometimes taking over a year to finalize due to heightened regulatory scrutiny, according to West Monroe partner Nathan Ray.

“It appears like there’s been a sort of recklessness in short-term thinking."

Mary Bugbee

Senior coordinator at the Private Equity Stakeholder Project

“Optum and UnitedHealth can't start their due diligence until after the FTC gives its approval,” said Hedgeye’s Simone. “There's no way any cash is going to come in the door from this transaction before the end of the forbearance period.”

If the Optum deal eventually closes, Private Equity Stakeholder Project’s Bugbee isn’t convinced the deal would help Steward’s long-term financial health. While it would give Steward some immediate cash, she said severing its physician group could undercut its efforts toward sustained profitability.

“It appears like there’s been a sort of recklessness in short-term thinking,” she said. “Even if the deal works, they still are going to be on the hook for payments to Medical Properties Trust. And they're no longer going to have a physician group to help drive revenue to pay that.”

MPT also raised the option of re-tenanting or selling some of Steward’s hospitals during a recent earnings call to pay down Steward’s debt — a move Massachusetts regulators support.

In a regulatory filing, Steward said it anticipated material changes regarding the sale of some of its acute care hospitals within the next year, but it didn’t clarify whether it intends to close, sell or buy facilities.

However, finding other operators to take on Steward hospital leases could prove difficult because the company has been accused of downgrading facility quality over time.

Sen. Elizabeth Warren, D-Mass., said Steward leaves a string of “zombie” hospitals in its wake that are open but barely functional. Clinicians likewise told Healthcare Dive that Steward emergency departments can be rundown, ill-equipped and lacking basic equipment.

As Batt put it, “What [healthcare] operator wants to absorb a carcass?”

Bankruptcy could provide ‘breathing space’

As Steward reaches the end of its credit line, bankruptcy could be one of Steward’s better options, experts said.

Bankruptcy could give Steward some breathing space from lenders, according to ASU law professor Coordes. Steward is currently facing at least 35 lawsuits across multiple states, the majority of which are collections cases.

“Bankruptcy law halts all other lawsuits and claims collections against the company,” she said. “If a company is being hounded by multiple creditors … bankruptcy can provide an opportunity to put a halt to those and then give a healthcare business the space to say, ‘Okay, where am I?’”

She clarified that Steward wouldn’t walk away unscathed from the proceedings, but it would likely pay significantly less to settle its debts in bankruptcy court than it would outside the system.

Lenders also may be relieved if Steward files, according to analysts.

Although lenders extended long lines of credit to indebted companies during the COVID-19 pandemic, that trend has since declined, Coordes said.

“I think lenders are starting to tighten the reins a little bit and maybe not be as forgiving as they would have been two or three years ago,” said Coordes.

The obscurity surrounding Steward’s finances may heighten the risk of extending further credit to the healthcare network, as the company has yet to file full audited financials from 2022 or 2023, according to the HPC.

“I think that those lenders who agreed to forbearance would want to get out of the situation,” said Simone.

Steward declined to comment on this article. MPT, Optum and UnitedHealth did not respond to multiple requests for comment.